Advisor shortcomings

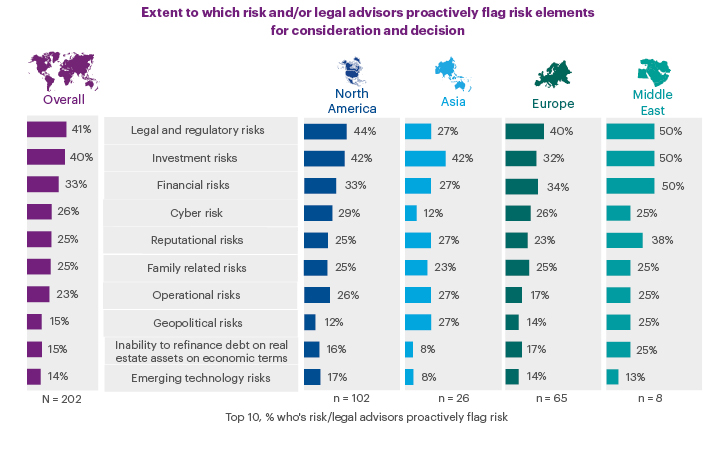

Given the existential nature of the dangers and their public prominence, it is remarkable that geopolitical and environmental concerns rank so low in priority. Infrequent monitoring by advisors explains why these hazards do not appear more prominently on family offices' risk radars.

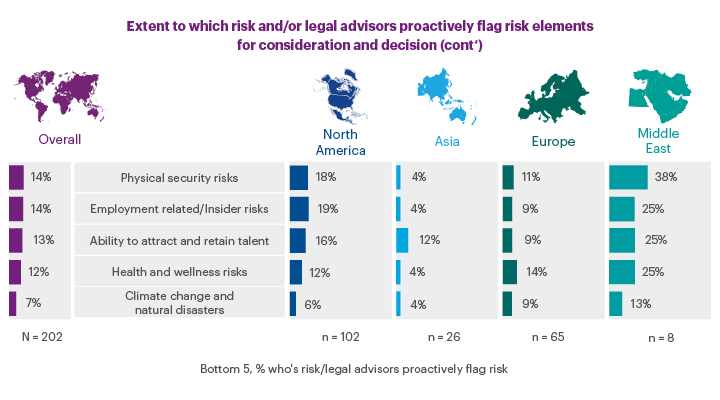

Just 7% overall say their advisors frequently flag climate change/natural disaster risks. And only about one in seven report geopolitical (15%) and emerging technology (14%) risks as being proactively tracked. Even fewer in Asia say climate change (4%) and emerging technology (8%) risks are frequently flagged.

Employment related/insider risks represent another significant blind spot, with just 14% globally saying their advisors are actively monitoring this area.

Deficient internal resources

Symptomatic of poor internal processes are the underdeveloped nature of certain key risk management areas. Only a slim majority (55%) overall say their internal teams know the right questions to ask advisors regarding managing and mitigating risks. This suggests that family office personnel lack the essential expertise and awareness to raise the most important issues with advisers.

The gaps in risk management programs thus result from both internal and external shortcomings. While external advisors are failing to raise red flags over key threats, family office staff are lacking the know-how to get the best out of their advisors.

Risk management culture

The lack of internal awareness in asking the right questions of advisors reflects larger flaws in the risk management culture within family offices.

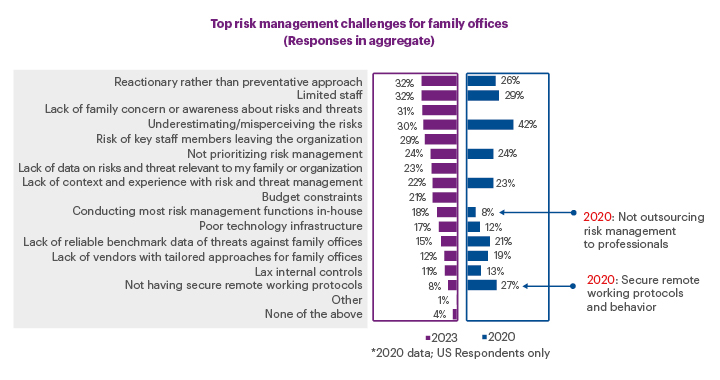

Indeed, three of the top four risk management challenges revolve around culture. These include a reactionary rather than preventative approach (32%), lack of family concern about, or awareness of, risks (31%), and underestimating risks (30%). Encouragingly, the number of people reporting underestimating risks has decreased from 42% in 2020 to 30% today.

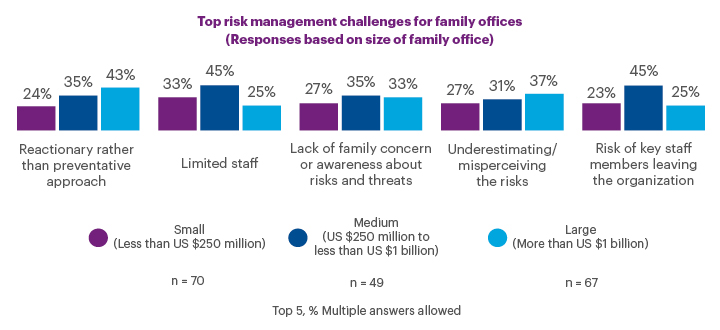

Large family offices with a net worth of more than US$1 billion are more likely to possess a reactionary mindset (43% vs. 24% of small firms with less than US$250 million). These bigger organizations are also more inclined to say they underestimate risks (37% vs. 27% small firms). This could be a function of the fact they have deeper monitoring resources at their disposal and are therefore more aware of gaps in coverage. Indeed, almost half of large family offices have dedicated internal resources to support investment risk monitoring, compared to a quarter of small firms (46% vs. 26%). This reinforces the earlier point that the more family offices understand the risks they face, the more they recognize the weaknesses that must be addressed.

A reactionary mindset is regarded as the most significant and growing risk management challenge. The proportion reporting a reactionary approach has risen from 26% in 2020 to 32%, indicating a growing sense of complacency and a lax risk management culture.

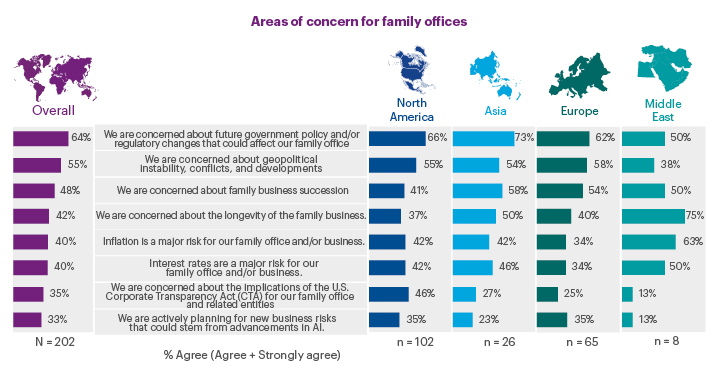

This increasingly reactionary mindset is all the more surprising given the greater threats facing family offices in today’s more perilous world. Furthermore, family offices recognize these dangers. More than half (55%) worry about geopolitical instability, as large firms display more pronounced anxiety (66%). However, levels of concern are not matched by levels of preparedness. Just 17% have well-developed processes to guard against these wide-ranging geopolitical risks including wars, political instability and terrorism.

Even more concerning is the impact of future government policy/regulatory changes (64%). With a record number of elections taking place around the world in 2024, family offices will need to closely monitor changes in government policy.

These top concerns are uncertain, unpredictable and unknown, which underlines the need to articulate a forward-looking risk management approach. This is an area where family offices could use tools such as war gaming, scenario analysis, intelligence collection and predictive analytics to help plan and prepare for future events.

Lessons could be learned from younger family offices, some of which have developed a more progressive risk management culture. Nearly a third (30%) of offices established over the last three to five years have robust programs for geopolitical risks—compared to just 13% of organizations established 11 to 20 years ago. Similarly, 22% of these younger entities have well-developed processes for climate change, compared to just 9% of those established more than 20 years ago. As a result, younger family offices appear to be better at managing and monitoring today's key existential risks.