Insurance

While cybersecurity risk programs are not up to scratch, a lack of adequate insurance coverage is amplifying vulnerabilities. Cyber insurance is held by less than half (48%) in North America, but this plunges to about a third in other regions. Furthermore, only 37% globally have adequate insurance and retainers for specialists to manage a cyberattack. While this rises to 46% of North American offices, it still means a majority are underinsured.

These two factors expose firms to potentially huge losses in the event of an attack. Family offices can be targeted for both business email compromise and/or wire fraud, so having cyber insurance is essential.

The lack of insurance is even more surprising given that a third of family offices turn to insurance companies (33%) as their first port of call in the event of a cyberattack. This highlights a further dichotomy in the way family offices approach cybersecurity in particular, and risk in general.

Although tech upgrades are seen by family offices as an effective way to strengthen risk capabilities in general, cyber insurance offers the most straightforward and effective method of mitigating this particular risk. Moreover, most cyber insurance policies provide access to specialized resources, while cyber insurance firms can help with risk assessments.

Proactive approaches are always warranted when evaluating risk management measures. Family offices would benefit from more regular engagement with legal advisors, designated outside counsel for risk management, insurance brokers or even dedicated general counsels or risk managers. While these are only two areas of concern, directors and officers (D&O) insurance shields individuals, while cyber coverage safeguards the entity itself. Proper protection demands a comprehensive strategy, particularly in today's evolving risk landscape and rapidly shifting cyber environment. The crux lies in aligning insurance coverage with the actual and estimated financial risks. This disparity highlights a pressing need for strategic collaboration with trusted insurance brokers to ensure adequate coverage and effective risk mitigation.

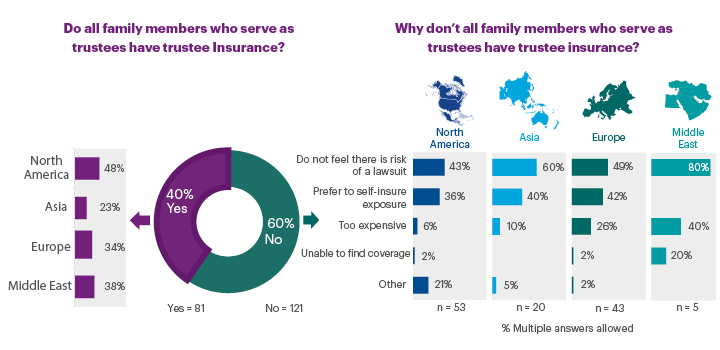

Further holes in coverage are evident in other insurance realms. Six in 10 (60%) say family members serving as trustees do not have trustee insurance. The primary reason cited is lack of concern over lawsuits (50%), followed by a preference to self-insure (37%), and cost (15%). More offices in the Middle East (80%) and Asia (60%) point to a lack of fear over lawsuits, while cost is a bigger factor for Europeans (26%). About a third (34%) plan to review insurable risks and insurance coverage over the next year.

Health care

Family offices point to specialists (54%) and quality of hospital care (54%) as the health care services they are most concerned about accessing. Around a third worry about accessing primary care (35%), emergency services (32%) and mental health resources (29%).

Reassuringly, seven in 10 in North America say their primary care physician understands their medical history and goals (71%), and that quality of health care is not a concern where they live (70%). Half (51%) receive support from their primary care doctor while travelling.

However, the findings show a transatlantic chasm in terms of satisfaction with health care. Europeans are more concerned than North Americans about access to specialists (66% vs. 50%) and the quality of hospital care (59% vs. 47%).

Additionally, Europeans are less likely to say their primary care physician understands their goals and that health care in their area is not a concern (62% vs. 77% for both). Moreover, considerably fewer Europeans receive support while travelling (33% vs. 63% North Americans). Further highlighting this gulf, only 17% of North Americans are concerned about accessing health care services when required, compared to 41% of Europeans.

Aviation

Nearly one in five (18%) family offices surveyed indicated that they manage an aviation operation. These operations are more common in North America (25% vs.13% Middle East, 12% Europe, 4% Asia).

Of those managing such operations, two-thirds (65%) prefer to outsource specific aviation functions such as strategic planning and safety management to specialists. Europeans have greater tendency to outsource these functions compared to North Americans (88% vs. 65%).

Meanwhile, half (51%) state they have an aviation safety management system to mitigate risk in flight operations. However, only a third (32%) have an emergency response plan (ERP) to manage operational or reputational crises involving aviation operations. North Americans (35%) are more likely to have an ERP than Europeans (25%).