The recent upending in crypto and digital asset markets, including bankruptcies of perceived industry-leading companies backed by strong investors, has created both skepticism regarding the asset class as well as opportunities for careful study and future opportunity. Family offices have not been immune to the enormous interest in cryptocurrencies and digital assets in the last few years. Nearly one in four (23%) family offices are investors in cryptocurrencies and/or digital assets, and another 30% are either planning to invest in the next 12 months or are taking a wait-and-see approach. Against this, just under half (47%) do not intend to invest in cryptocurrencies and digital assets, showing a clear split among family offices on this emerging asset.

Family members are more likely to have a firm view either way on cryptocurrencies than non-family members; 36% of family members say that they are investing in crypto, while 51% do not plan to invest and only 13% are taking a wait-and-see approach. The largest SFOs and FEs are also more likely to be investing in cryptocurrency, as over a third (36%) are already investing or plan to do so in the next 12 months. By region, family offices in the Middle East (35%) and North America (30%) are most likely to be investing in cryptocurrencies, while Latin American family offices (75%) are least likely to invest in this area.

For family offices, there are several reasons to invest in cryptocurrencies and digital assets. The most popular rationale is the potential for outsized gains (58%), ahead of diversification from traditional assets (52%), taking advantage of an emerging market (49%), focusing on the “picks and shovels” of cryptocurrency/blockchain (46%) or to gain knowledge of cryptocurrencies and how they work (46%).

Family members are particularly likely to be attracted by the potential for outsized gains (69%) or as a hedge against conventional currencies (37% vs. 24% overall). By region, the strongest rationale for investing in cryptocurrencies for North American family offices is taking advantage of an emerging market (63%), while diversification is a strong driver for Asia Pacific investors.

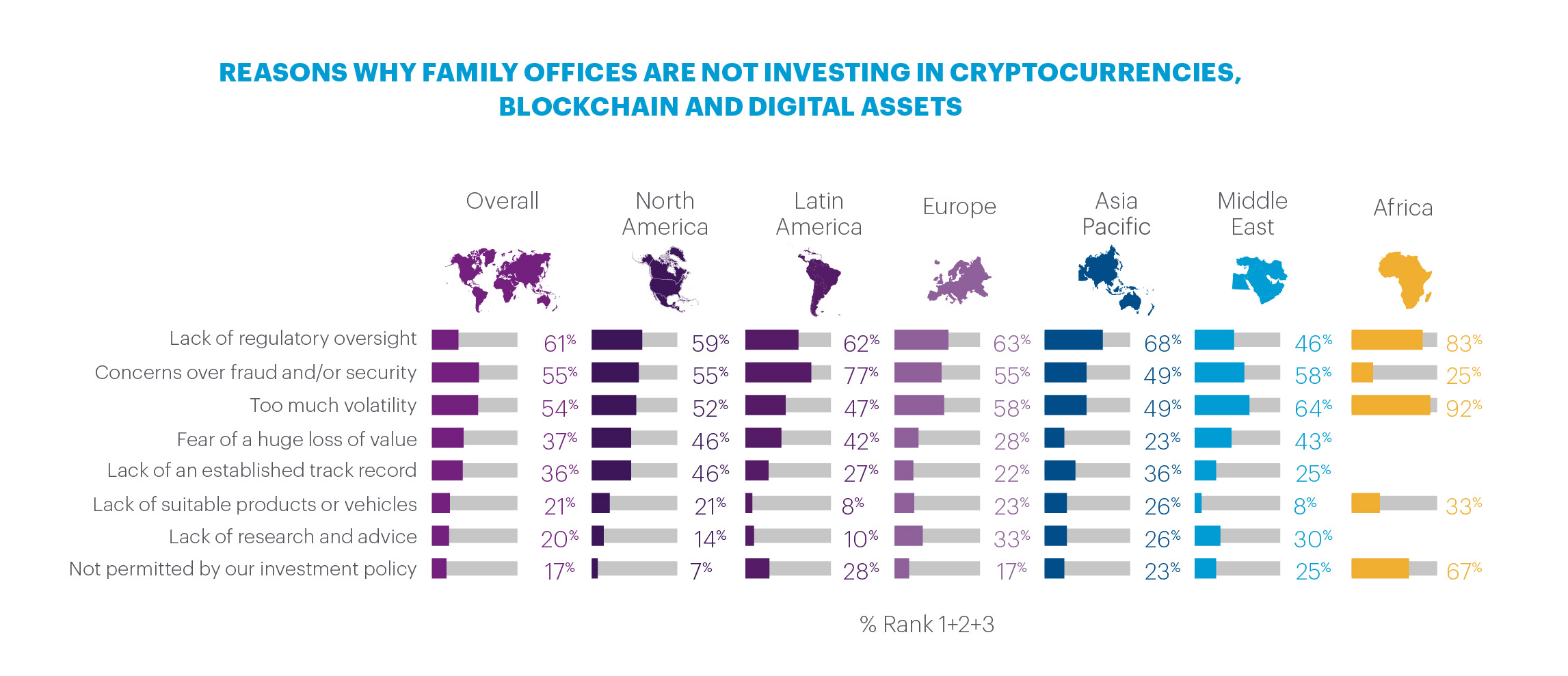

When asked about reasons for not investing in cryptocurrencies, the lack of regulatory oversight (61%) was the biggest reason overall. Concerns over fraud and security (55%) and volatility (54%) are also prominent disincentives. There are some significant differences between family members and non-family staff on this topic. Family members are more worried about a huge loss of value, for example, with nearly half (46%) citing this, compared to 35% of non-family staff. Family members also dislike the lack of an established track record for cryptocurrencies. For non-family staff, the lack of regulatory oversight and the lack of research and advice are bigger deterrents to investing in this area.