The need for specialist support

Investment risks clearly are a key priority for family offices. At the same time, family offices display weaknesses when managing these risks. A core deficiency is the lack of concrete structures and formalized policies. Only half have an investment policy statement (50%) or formal investment committee structure (50%).

Family offices are also coming up short when monitoring and analyzing investment risks. Only about a third holistically monitor risks across asset classes (36%) or actively track the interconnection of risk factors (34%). Plus, just 17% have tail risk hedging strategies.

These shortcomings reflect a lack of internal expertise. Only 35% have dedicated internal resources to support risk monitoring, underscoring the need to outsource investment functions to specialists. However, only a slim majority (54%) use external support from asset managers or consultants.

MFOs have more advanced capabilities than SFOs across all areas of investment risk management. This is particularly evident when holistically monitoring asset classes (45% vs. 33%).

An evolving risk landscape

The task of managing investment risks is made more difficult by the changing nature of threats set against a volatile and uncertain market backdrop. This is prompting family offices to implement meaningful portfolio modifications in line with revised investment objectives. Two in five (41%) have significantly changed portfolios in response to higher investment risk assessments. A similar proportion (40%) have greater appetite for direct investments due to shifting risk conditions. Finally, 38% agree their investment objectives have significantly altered over the past three years owing to changing risk evaluations.

More respondents in the Middle East (50%) and Europe (45%) have enacted portfolio changes. Offices in the Middle East also have greater appetite for direct investments (88%) and are more likely to make major revisions to investment objectives (63%).

The challenges presented by these fluctuating market forces bring into sharper focus the benefits of hiring external investment experts. Active asset managers in particular can help family offices navigate market volatility through tactical asset allocation. They can also help them gain exposure to direct investments and other diversifying alternatives uncorrelated to public markets. In today’s uncertain markets, family offices recognize the need to work with the right asset managers. Nearly half (47%) say the evolving risk environment is encouraging them to reevaluate their asset managers. This is particularly important as the dependence of asset managers on external partners, such as financial institutions and service providers, exposes the family office to counterparty risks, including defaults and operational failures.

Another area where asset managers can lend support is environmental, social and governance (ESG), which is not currently high on the agenda. Just 28% say ethical strategies and ESG considerations play an important role in their investment strategies. Europeans (35%) attach the most importance to ESG.

Investment risk solutions

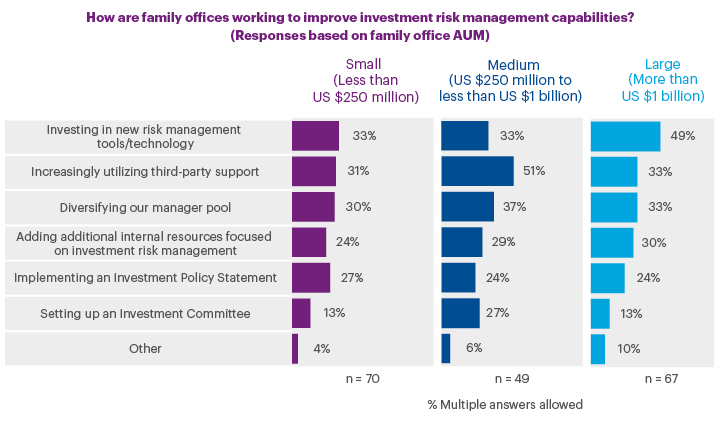

Nearly four in 10 are looking to improve their capabilities by investing in new risk management tools (39%) and using third-party support such as consultants (36%). About a third (32%) are working to diversify their manager pool.

However, internal factors are less of a priority. Only about a quarter plan to implement an investment policy statement (25%) or add investment-focused internal resources (27%). Just 17% are looking to set up an investment committee.

The methods chosen to boost capabilities are influenced by organization size. More medium-sized firms turn to third-party support (51%) and look at diversifying their manager pool (37%). Large entities, on the other hand, are more likely to invest in risk management tools (49%), reflecting their deeper resources.