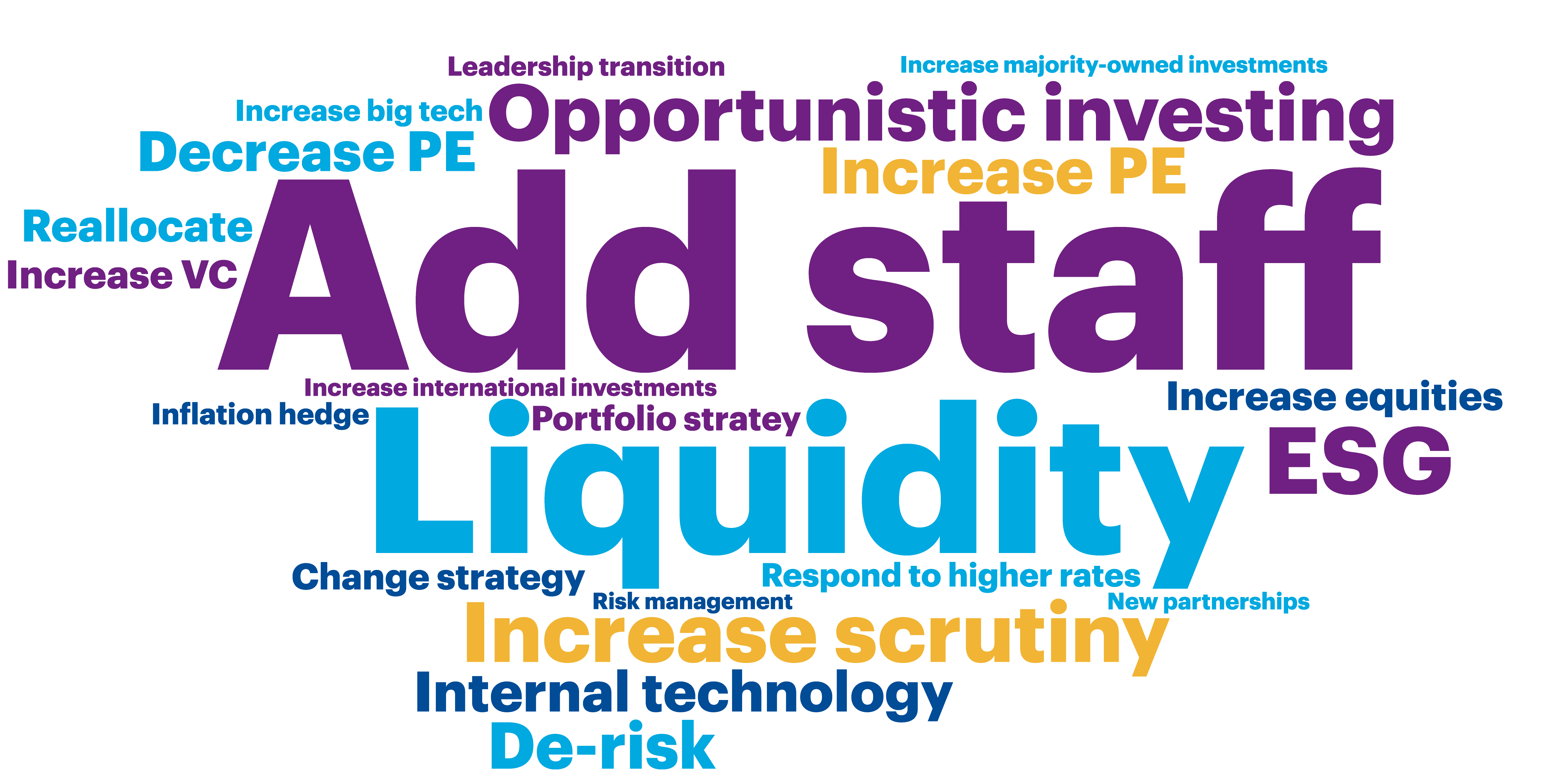

Family offices face an uncertain investment outlook following Russia’s invasion of Ukraine and the lingering impacts of the COVID-19 pandemic. The pandemic’s disruption to labor markets and global supply chains, combined with huge injections of liquidity through quantitative easing and low rates, has triggered a sharp rise in inflation worldwide. China, an engine driving growth in the past two decades, has seen its economy slow due to a series of coronavirus-related lockdowns and the disruption to globalization, among other factors. Adding to these macroeconomic and geopolitical shocks were falling bond and equity markets in 2022. As this word cloud

shows, family offices are worried about various threats in 2023, but inflation, recession and the economy are foremost on their minds.

Family offices on their biggest concerns for 2023

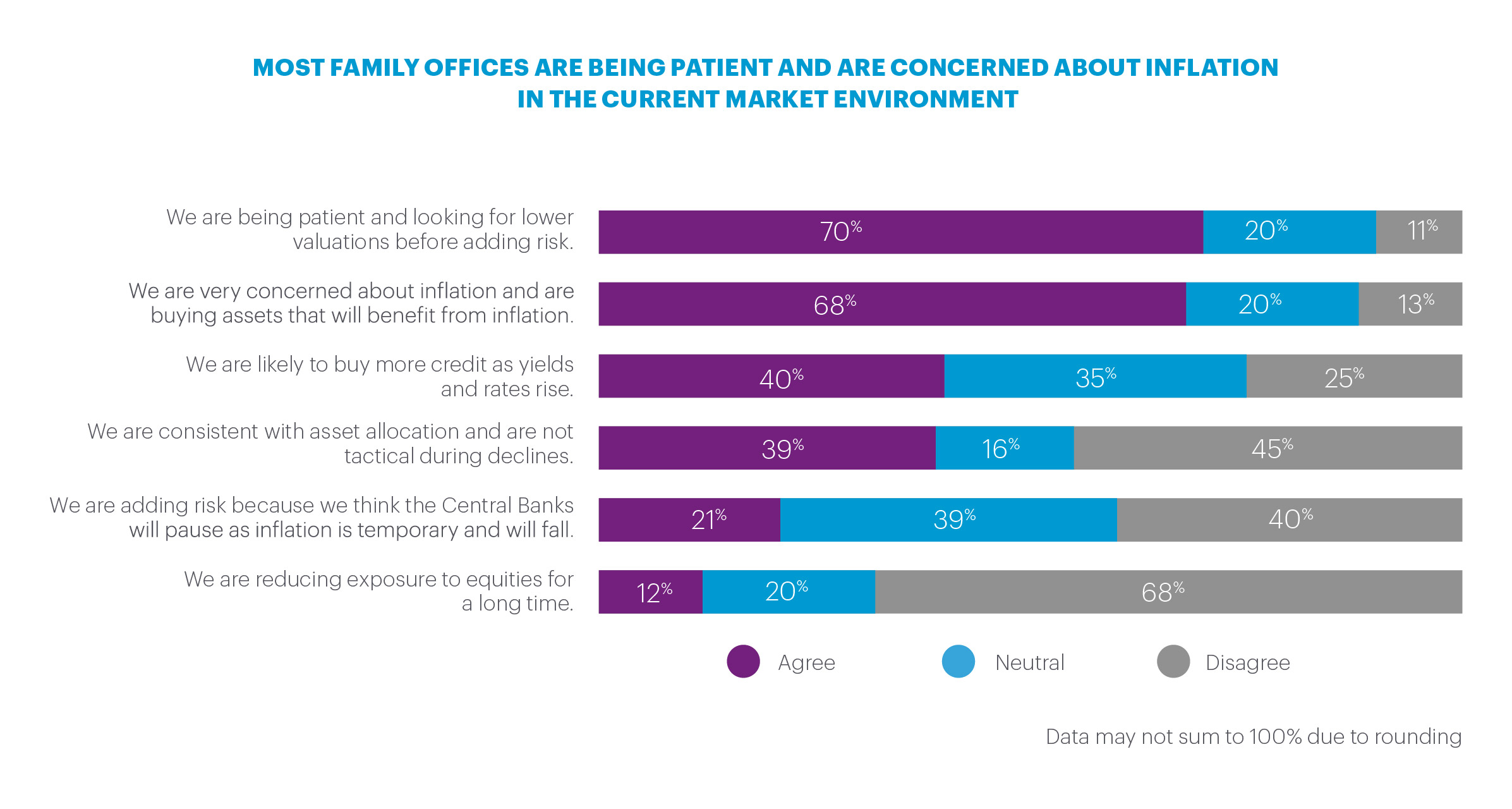

Asked about the current market environment, over two-thirds of family offices (68%) are very concerned about inflation and are buying assets that will benefit from inflation. This number increases to 80% in the Middle East. Seventy percent (70%) are taking a wait-and-see approach, poised to add risk when valuations fall, while others have already started to hunt for bargains—just over half of family offices (53%) say they are taking advantage of market falls to add more equity exposure. On a geographical basis, family offices in Asia Pacific (75%), Latin America (58%) and the Middle East (55%) are most likely to be using market falls to buy equities, while those in North America (45%) and Europe (42%) are less likely to do so.

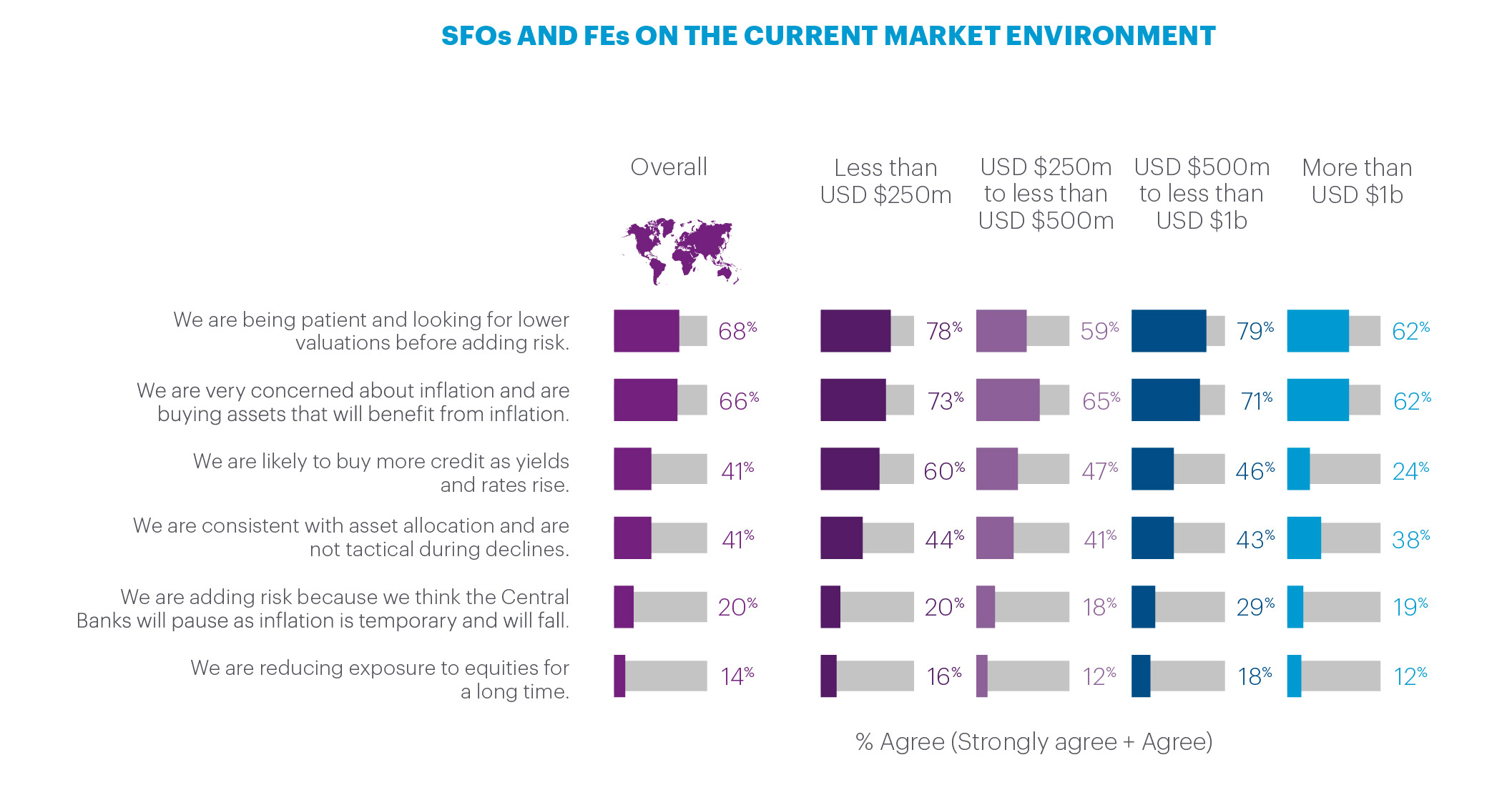

We can see that larger family offices are better positioned to look through current market threats, such as inflation or market slumps. For example, the largest single family offices (SFOs) and family enterprises (FEs), with over $1 billion in assets under management (AUM), are slightly less concerned about inflation (62%), but the smallest SFOs and FEs, with under $250 million, are slightly more concerned about inflation (73%). The same pattern exists on being patient and looking for lower valuations before adding risk; the largest SFOs and FEs are less inclined to take this view, while the smallest are more likely to be watching and waiting for lower valuations. Please note that “family enterprise” is defined as a family-owned operating business(es) that also manages the assets and/or affairs of the family.

Another interesting comparison in this survey is between family members and non-family members (the latter group consisting of C-suite executives, investment professionals or portfolio managers, board or investment committee members, and in-house staff covering legal matters, accounting and tax, real estate and other areas). Here, family members and non-family members have a very similar level of concern over inflation, but family members are more likely to say they are being patient and looking for lower valuations before they add risk (76% vs. 67% for non-family office members and 70% overall)—an indication, perhaps, that family members are more careful, while investment staff are more willing to seek returns, in this environment.

Family offices on changes they plan to make in 2023

Key findings

1) Family offices are defensively positioned amid market volatility

70% of family offices are being patient and looking for lower valuations before adding risk, indicating they expect further declines in asset values. For 64%, avoiding losses and volatility is a key objective.

2) Family offices use diversification

85% of family offices believe in broad diversification of factors, and 74% use diversification across geography. In private equity, 69% work to invest across different fund vintages.

3) Interest in private markets and direct investing is high

60% of family offices believe that private markets often have the best opportunities now, rising to 72% in North America. 63% make direct investments, with another 22% saying they do not but that it is of interest. At family offices with direct investments, the average allocation is 37% of private equity assets under management.

4) Family offices are facing the challenges of direct investing

Family offices are grappling with numerous direct investment challenges, including taking on too much operational risk (45%), finding high-quality deal flow (43%), having control of exit options (42%) and finding enough time for proper due diligence (41%).

5) Digital assets offer potential outsized gains and diversification for many, but caution abounds

Noting that survey respondents submitted during the latest high-profile meltdowns in the crypto markets, nearly a quarter (23%) invest or are planning to invest in cryptocurrencies and/or digital assets. A further 30% are potential investors taking a wait-and-see approach. The biggest drivers are the potential for outsized gains, diversification and taking advantage of an emerging market. On the backdrop of crypto market declines, almost half of family offices do not currently plan investments in digital assets.

6) Family members are heavily involved in important investment decisions

Only 8% of family offices defer entirely to family office staff to make investment decisions. 30% of respondents say important investment decisions are made by family office staff in collaboration with family members. For 29%, key family members alone make these decisions. Almost two-thirds (65%) of family offices have a formal investment policy statement.

7) Deep expertise is the most important criterion for external partners

When selecting an external partner, service provider or supplier, deep expertise in specialist areas is the most important criterion for 65%. The biggest reasons to seek external legal advice are trust-and-estate planning, M&A, litigation, investment structures for different investment entities and direct investments.

8) Looking ahead: Inflation protection and future investments

Over two-thirds (68%) are very concerned about inflation and are buying assets that will benefit from it. The most likely future industries of interest for direct investments are healthcare (65%), disruptive technology/digital tech (61%) and commercial property (58%).

9) Improved deal flow is prized by family offices in 2023

Asked about their top needs for 2023, deal flow was No. 1 among family offices, with more opportunities and better-quality deals and/or new partners wanted. In addition, guidance on investment strategies and portfolio management in a tough environment, and advice on tax and legal issues are in demand.

10) New talent acquisition and strategy shifts are on the agenda for 2023

Adding talented new staff, upskilling existing staff and investing in new technologies are among the most frequently mentioned planned changes for 2023 by family offices. Some are planning strategic shifts, such as increasing downside protection or increasing liquidity.