Conclusion

This family office direct investing report is a strong first step into examining how family offices, especially SFOs and FEs, are tackling numerous opportunities and challenges. Facing headwinds from higher inflation and interest rates, market fluctuations and recession risks, as well as global concerns such as conflict in Ukraine and uncertainties in China, family offices are retaining their faith in making direct investments, as well as in diversification, as part of their overall plans to manage risk and return. For many family offices, direct investing is a key part of their investment strategies, enabling them to target attractive opportunities, in ways that can avoid short-term market volatility and often provide enhanced transparency, influence and/or control.

While family offices are likely to be defensively positioned at present, they still want to invest in the key areas for future growth to preserve wealth and achieve attractive returns. As we look deeper at how single family offices and family enterprises view investing and governance, we can see that family offices are dealing with the hurdles of direct investing. To do this, working with partners who can bring deep expertise to the table is vital, as family offices recognize. As families look ahead to 2023 and beyond, finding talented new staff, high-quality deal flow, managing diligence and operational risk, and strategic shifts are top of mind for family offices, showing how they are focused on proactively managing opportunities in a changing world. If we are indeed moving into a new macroeconomic and geopolitical era, after “the Great Moderation” of cheap money and relative stability, family offices are doing their best to ensure this transition does not halt their mission of investing family wealth to achieve long term goals in a shrewd and long-term manner.

In future reports on this topic, we intend to explore in detail related topics such as the relationships between FOs and independent sponsors; how family offices in Latin America, Africa and Asia operate; FO technology; and how family offices are upgrading their governance to better manage direct investing and as they grow and institutionalize operations.

Background to survey

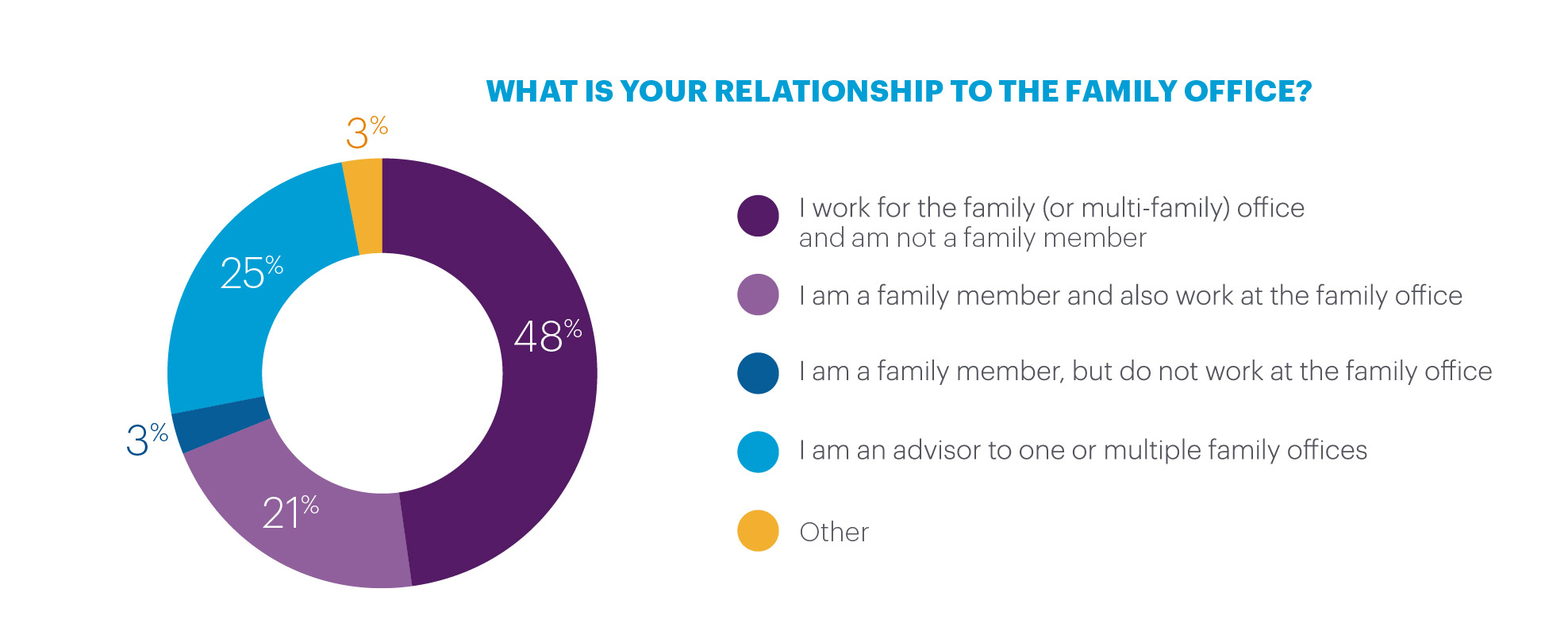

The findings here are based on the views of 188 individuals at family offices from 32 countries around the world, with 44% in the United States. Most respondents (73%) either work at family offices or are advisors to one or multiple family offices. Nearly a quarter of respondents (24%) are family members, with most of these also working in their family office or a multi-family office (MFO).

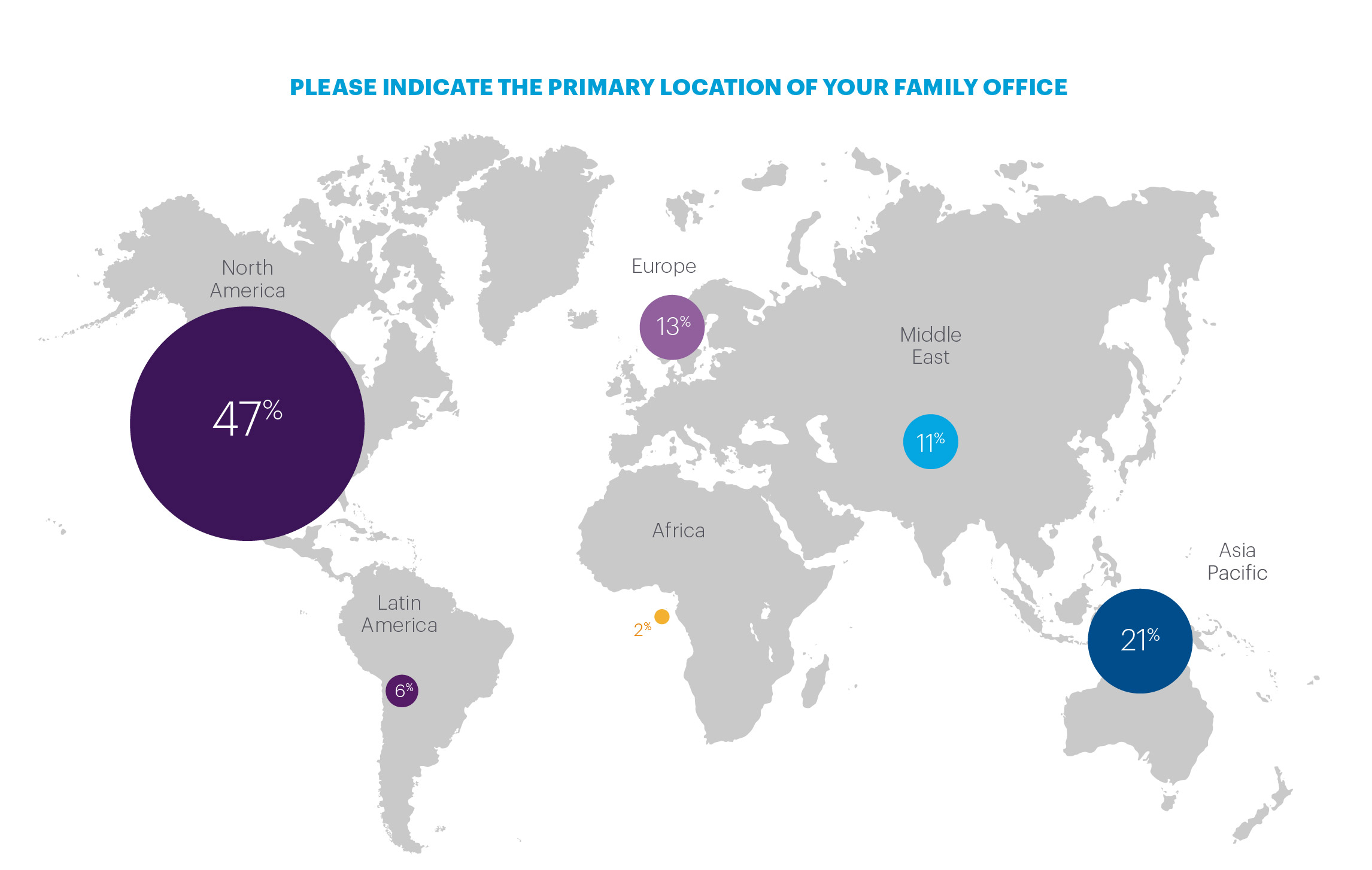

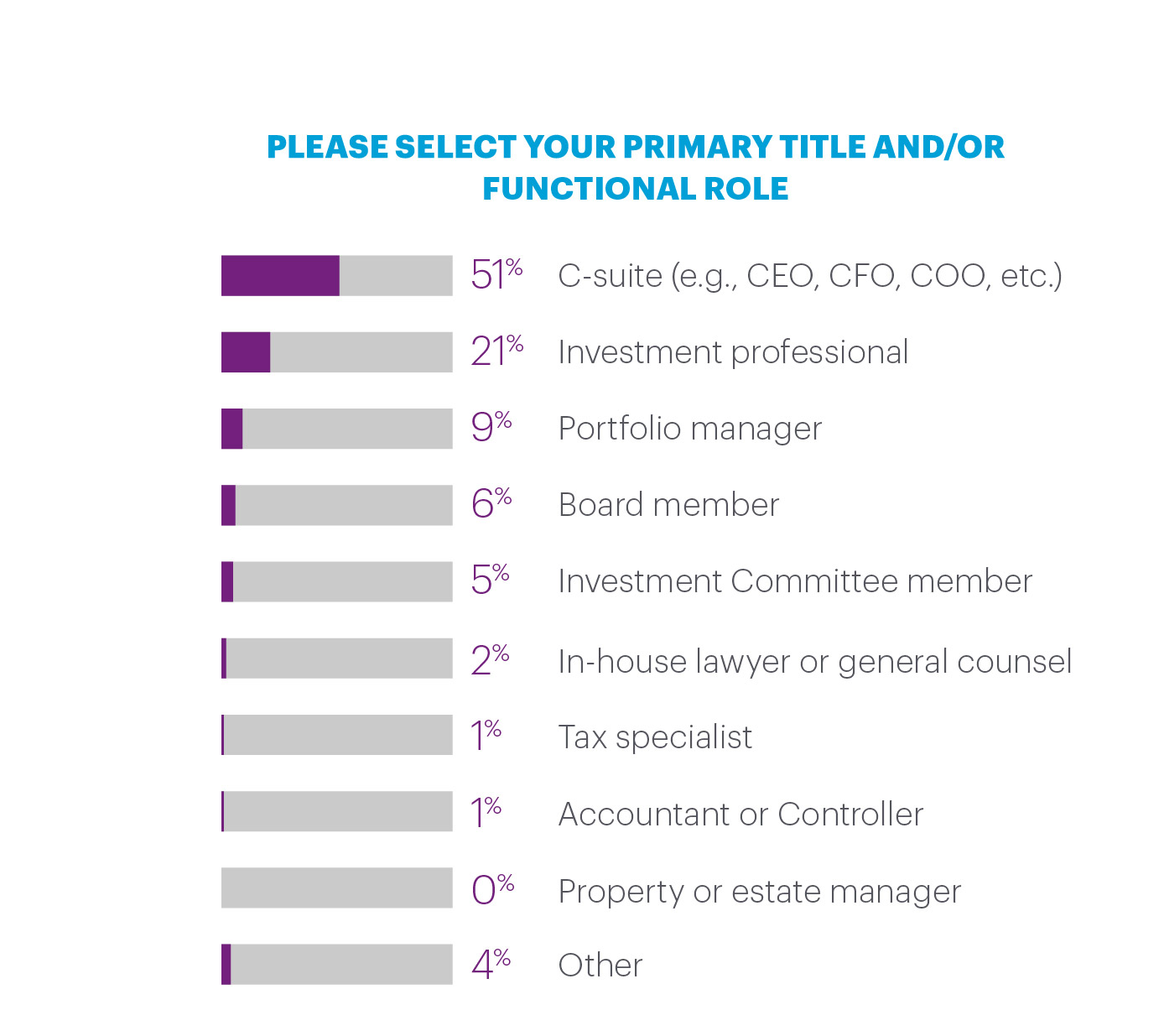

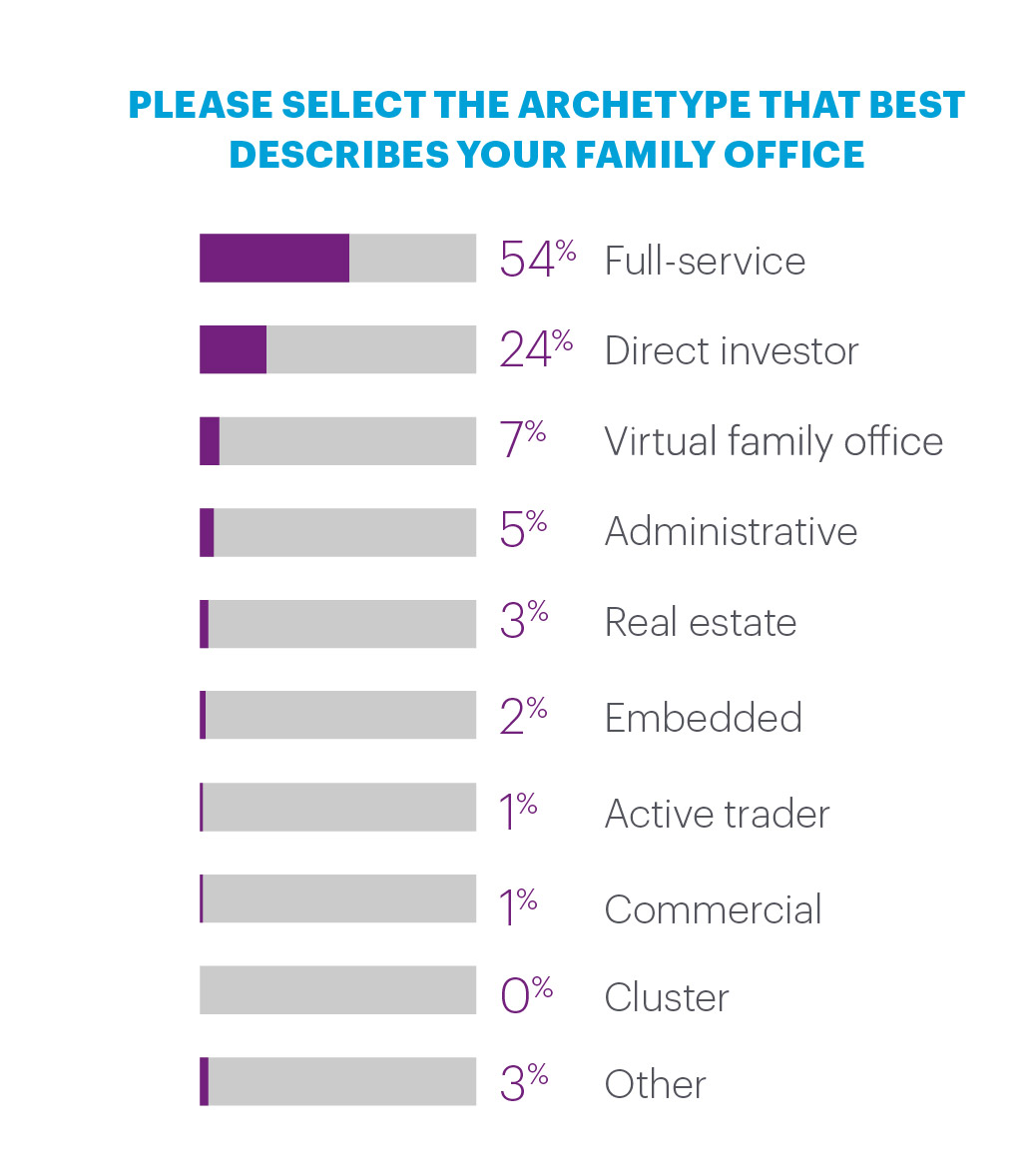

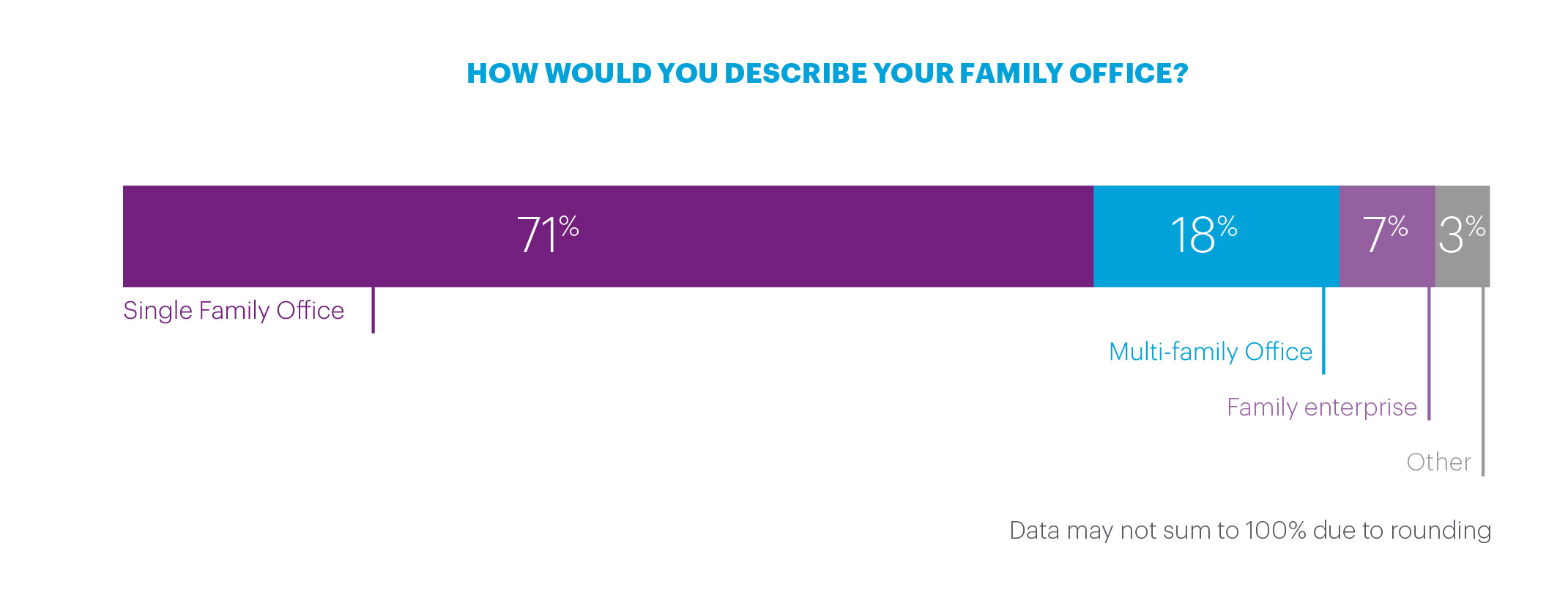

Half of the respondents are C-suite (e.g., CEO, CFO or COO), while 21% are investment professionals, 9% are portfolio managers and 6% are board members. By region, 47% of respondents are based in North America, 21% in Asia Pacific, 13% in Europe, 11% in the Middle East, 6% in Latin America and 2% in Africa. SFOs are the most common type of family office, for 71% of respondents, while 18% are at MFOs and 7% are at FEs (i.e., family-owned operating businesses that also manage the assets and/or affairs of the family).

Survey partners

Dentons thanks our survey partners for their assistance and leadership in bringing these findings to the family office community.

- William Blair

- McFarland Partners

- Simple

- Family Wealth Report

- The UHNW Institute